In general, debiting a liability account decreases the amount of money that the company owes, while crediting a liability account increases the amount of money that the company owes. Most accounting software forces you to keep your books in balance because it will not allow you to save an entry that doesn’t have equal credits and debits. When you’re keeping your own books, it’s important to understand how to record both debits and credits. If you want to decrease your liabilities without also decreasing your assets, you need to find someone willing to invest in your business. The key difference between debits and credits lies in their effect on the accounting equation.

Using this framework, we decompose credit card profitability into its main sources— the credit function, the transaction function, and fees—and present three main findings. Deferred, or unearned revenue can be thought of as the opposite how to compile and use income statement of accrued revenue, in that unearned revenue accounts for money prepaid by a customer for goods or services that have yet to be delivered. Revenue is the income generated by a business from its operations, sales of products or services.

The benefits of recording revenue as a credit

The above three entries do not require a company to record revenues when it receives cash. This income also impacts a company’s equity, increasing it when a company generates revenues. It is one of the five fundamental accounts that exist in financial statements. The accounting treatment for revenues is similar to any income companies generate. For service-based companies, these revenues may include fees earned from providing services.

- Successful business owners want their books to balance at all times.

- You also use a chart of accounts, that includes items like rent, utilities, payroll, and more.

- Companies then reduce their expenses from this amount to reach their profits.

This number is important to potential investors because it helps them understand your net worth. If they see steady growth in your shareholders’ equity through increased retained earnings, your company may be an appealing investment. It provides information about your cash payments and cash receipts, as well as the net change of cash after all financing and operating activities during a set period. If you ever apply for a small business loan or line of credit, you may be asked to provide your income statement. We may have moved away from “managing the books” in an actual paper ledger and painstakingly entering each journal entry with a quill pen, but the premises of accounting remain untouched through time. It is imperative that you make doubly sure to keep up with your liabilities at all times.

Is service revenue a current asset?

When a sale occurs, the revenue (in the absence of any offsetting expenses) automatically increases profits – and profits increase shareholders’ equity. It is notable that heavy and light revolvers pay not only the bulk of interest charges, but also the majority of credit card usage fees. Second, we show that the net interest margin on revolving balances—that is, balances that are carried from previous months—has been increasing in recent years. In order to record revenue from the sale of goods or services, one would need to credit the revenue account. This means that credit to revenue would increase the account, whereas a debit would decrease the account. An increase in debits will decrease the balance of a revenue account.

Debits and credits come into play on several important financial statements that you need to be familiar with. In this lesson, learn the revenue definition, see revenue examples and learn the difference between revenue and income. Here at Seek Capital, we want you to be as successful as you possibly can be. With the right guidance and direction, you can learn how to make the most of your business venture while discovering new and exciting ways to increase revenue, secure business loans, and much more. In this guide, we will discuss what all this means and why revenue has to be recorded as a credit. This will go a long way in helping you make sure that you are entering the correct data each and every time a transaction is completed in your business.

Margin Debit

For a retailer, this is the number of goods sold multiplied by the sales price. Another good idea to ensure you’re a low-risk investment is to take a look at your business credit report to understand how creditors see your company. That, along with checking your business credit scores, can help you have a good handle on your finances. Even if your accounting software automatically downloads each liability transaction and invoice, you still should be involved with your accounts, adjusting entries when needed.

In this case, when you make a sale, you will credit your account receivable (AR) for the amount of the sale while debiting your sales account. When it comes to recording revenue in your books, there are a few key steps you’ll need to follow. First, you’ll need to determine the amount of revenue earned within a given period.

The first step is figuring out total annualized operating expenses, including wages and benefits for staff members. Service revenue is the net income a company earns from the services provided. It refers to all activities a company performs to generate economic benefits to the business and its customers. Service revenue doesn’t include interest income or income earned from product shipments. You need to know how much service revenue your company generates per year and what percentage of overall sales it represents.

The benefits of recording revenue as a debit

By keeping track of every transaction, you can avoid any confusion or discrepancies that could lead to bigger problems down the road. Additionally, revenue can be made from the interest that the business receives from investments. Non-operating revenues are the income that the company earns from business activities aside from its main business operations.

Typical examples of nonoperating revenues include interest revenue, dividend income and asset sales. Of the remaining 32 percent of accounts, half are inactive, and half do not have a twelve-month history. Note that to be consistent with equation 3, Figures 3A and 3B show NTM and rewards expenses on a quarterly basis.

Revenue accounts in a double-entry bookkeeping system are general ledger accounts that are summarized periodically under the heading Revenue or Revenues on an income statement. Then, the revenue account names describe the kind of revenue, such as Rent revenue earned, Repair service revenue, or Sales. The revenue accounts record all increases in equity such as sales, services rendered, rent income, interest income, recurring receivables, membership fees, interest from investment, donations etc.

Pros and Cons of Recording Revenue as a Debit or Credit

One essential aspect of financial management is recording revenue – but do you know whether it’s considered a debit or credit? In this blog post, we’ll dive into what revenue is and explore how to record it in your books. Plus, we’ll weigh the pros and cons of recording revenue as a debit or credit.

Fitch Rates Concord, NC’s $42MM GO Bonds ‘AAA’; Outlook Stable – Fitch Ratings

Fitch Rates Concord, NC’s $42MM GO Bonds ‘AAA’; Outlook Stable.

Posted: Mon, 31 Jul 2023 21:06:00 GMT [source]

Now, if the company earns an additional $500 of revenue but allows the customer to pay in 30 days, the increase in the company’s assets will be recorded with a debit of $500 to Accounts Receivable. Because the revenue was earned, this must also record a credit of $500 in Sales Revenues. The credit entry in Sales Revenues also means that the owner’s equity will be increasing. To illustrate why revenues are credited, let’s assume that a company receives $900 at the time that it provides a service and therefore is earning the $900.

For example, a company sells $5,000 of consulting services to a customer on credit. One side of the entry is a debit to accounts receivable, which increases the asset side of the balance sheet. The other side of the entry is a credit to revenue, which increases the shareholders’ equity side of the balance sheet.

If you want to increase your assets without also increasing your liabilities, you need to find someone willing to invest in your business (i.e., give you a credit against an outstanding invoice). You also use a chart of accounts, that includes items like rent, utilities, payroll, and more. It helps you organize and index all your accounts and transactions, usually in a chart format. A Credit Memo is a type of supplier transaction where the University is receiving credit from the supplier with instruction to handle as a reduction to a future payment. Service revenue is an account that is used to reflect the net amount of revenue earned from providing services.

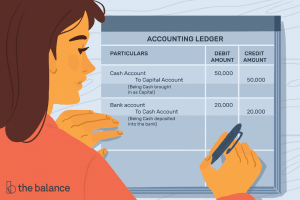

Once you’ve decided how best to record the revenue in your books, be sure to enter all relevant details into your accounting software or ledger book. This should include information such as customer name and invoice number for future reference. There are several groups of accounts that are included in your financial statements. One option is to create two separate ledgers, one for debits and one for credits. Another option is to use a software program that will automatically keep track of both types of entries. Whichever method you choose, be sure to keep accurate records so that you can always know where your money is going.

On April 20, 2023, an appendix was added to ease the interpretation of Figures 3A and 3B. The figures in the appendix are monthly versions of Figures 3A and 3B, which show income and expenses per dollar of purchases. If a company doesn’t have sufficient revenue to cover the above items, it will need to use an existing cash balance on its balance sheet. The cash can come from financing, meaning that the company borrowed the money (in the case of debt), or raised it (in the case of equity).